The Tampa housing market is an essential part of the Florida housing market, with a relatively high population density and close economic ties throughout the region. Tampa Real Estate is one of the most affordable in the state of Florida. It is also one of the hottest real estate markets for rental homes in the nation.

Considering the comprehensive analysis of the housing market in December, it appears to be a market where both buyers and sellers need to adapt to evolving conditions. The increased inventory and extended time to contract provide buyers with more options and potentially more negotiating power. On the other hand, sellers benefit from higher median sale prices and a shorter time to secure a contract. Striking the right balance between these factors is key for successful real estate transactions in the current landscape.

Tampa Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In December 2023, the real estate market witnessed a notable shift, with various key indicators reflecting the state of affairs, according to the data released by the Greater Tampa REALTORS®. Let’s delve into the data to understand the current scenario

- Closed Sales: The number of closed sales recorded a decrease, standing at 2,773, reflecting an 8.6% decline compared to December 2022.

- Paid in Cash: Interestingly, the proportion of transactions paid in cash remained steady at 768, showing no change from the previous year.

- Median Sale Price: The median sale price experienced a positive uptick, reaching $4,10,000, indicating a 4.0% increase from December 2022.

- Average Sale Price: The average sale price surged to $5,24,747, marking an 8.2% rise year-over-year.

- Dollar Volume: Despite the median and average sale prices climbing, the overall dollar volume witnessed a marginal decline of 1.0%, standing at $1.S billion.

- Med.Pct. of Orig. List Price Received: Sellers received 96.9% of the original list price on median, reflecting a 1.7% increase from the previous year.

- Median Time to Contract: The time taken to secure a contract decreased by 6.9%, with the median time standing at 27 days.

- Median Time to Sale: Homes spent less time on the market, with the median time to sale decreasing by 2.8%, reaching 69 days.

How Competitive is the Tampa Housing Market?

The data suggests that the housing market is experiencing competitive dynamics, as evidenced by the reduced time to contract and sale. Buyers and sellers alike need to navigate this landscape with a keen understanding of the factors at play.

Are There Enough Homes for Sale in Tampa to Meet Buyer Demand?

Examining the supply side of the market, the statistics reveal some interesting insights.

- New Pending Sales: The number of new pending sales saw a dip of 7.3%, indicating potential challenges in meeting buyer demand.

- New Listings: The supply of new listings remained relatively stable, with 2,723 new properties coming onto the market, showing no change from the previous year.

- Pending Inventory: The total number of pending inventory decreased by 11.6%, emphasizing the need for a balanced market to accommodate buyer needs.

- Inventory (Active Listings): While the overall inventory witnessed a slight increase of 2.9%, standing at 8,568 active listings, it’s essential to assess the composition and suitability for potential buyers.

What is the Future Market Outlook?

As we navigate the intricacies of the real estate market, it’s crucial to look ahead and project the possible trajectory based on the current trends.

Months Supply of Inventory: The months supply of inventory increased by a significant 18.2%, reaching 2.6. This metric provides insights into the balance between supply and demand, with a higher value suggesting a potentially more favorable environment for buyers. It refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. Six months of supply has historically been associated with moderate price appreciation, while a lower level of months’ supply tends to accelerate price increases.

Tampa Housing Market Forecast for 2024 and 2025

Metropolitan Statistical Area (MSA): The Tampa-St. Petersburg-Clearwater Metropolitan Statistical Area, commonly referred to as Tampa MSA, encompasses several counties in Florida. These include Hillsborough, Pinellas, Pasco, and Hernando counties, forming a vibrant economic and cultural hub.

Key Housing Metrics Explained

1. Average Home Value

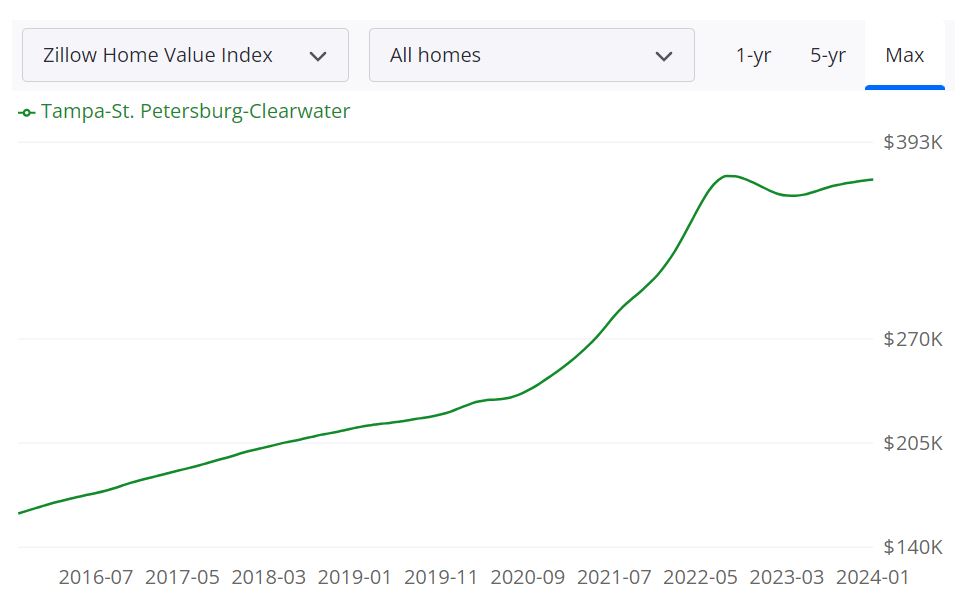

The average home value in the Tampa-St. Petersburg-Clearwater area stands at $370,474, reflecting a 1.9% increase over the past year. This is a positive sign, indicating a steady and resilient housing market.

2. Market Forecast

According to Zillow’s market forecast as of January 31, 2024, there is a promising +6.4% projection for the upcoming year, suggesting continued growth and demand in the housing sector.

3. For Sale Inventory

As of January 31, 2024, there are 15,247 homes available for sale in the Tampa area. This inventory provides options for potential buyers, contributing to a diverse and competitive market.

4. New Listings

In January 2024 alone, 4,195 new listings entered the market. This influx of properties adds to the overall housing supply, potentially meeting the demand from prospective homebuyers.

5. Median Sale to List Ratio

The median sale to list ratio, as of December 31, 2023, is 0.980. This ratio indicates the relationship between the listing price and the actual sale price, offering insights into negotiation dynamics within the market.

6. Median Sale Price

As of December 31, 2023, the median sale price for homes in the Tampa area is $358,333. This figure represents the middle point of all sale prices, providing a benchmark for property values.

7. Median List Price

The median list price, as of January 31, 2024, is $403,000. This is the midpoint of all current listings, indicating the average expectation of sellers in the market.

8. Percent of Sales Over and Under List Price

Examining the data from December 31, 2023, 15.4% of sales were conducted over the list price, while 65.3% were under the list price. These percentages highlight the negotiation dynamics and the prevalence of competitive pricing strategies in the market.

Is Tampa a Buyer’s or Seller’s Housing Market?

Understanding whether the current state of the Tampa housing market favors buyers or sellers is crucial for making informed decisions. As of the latest data, the market leans slightly towards being a seller’s market.

The limited inventory of 15,247 homes for sale suggests a competitive environment where sellers may have the upper hand. Additionally, with 15.4% of sales occurring over the list price, it indicates a demand that could drive prices higher.

Contrary to concerns about dropping home prices, the data reveals a 1.9% increase in the average home value over the past year. This positive growth signifies a stable market, and there is no immediate indication of a significant decline in home prices.

Will the Tampa Housing Market Crash?

The current data and market forecast from Zillow, projecting a +6.4% increase, do not suggest an imminent housing market crash. However, it’s essential to acknowledge that real estate markets can be influenced by various factors, and continuous monitoring is advisable for any market shifts.

Is Now a Good Time to Buy a House in Tampa?

Considering the seller’s market dynamics and the positive forecast, now may still be a good time to buy a house in the Tampa area. However, individual circumstances and preferences play a significant role. With median prices and a competitive market, potential buyers should be prepared for strategic decision-making and potentially higher-than-list prices.

It’s recommended for buyers to work closely with real estate professionals, stay informed about market trends, and assess personal financial readiness before making significant decisions.

Tampa Real Estate Investment Overview

Now that you know where Tampa is, you probably want to know why we’re recommending it to real estate investors. Should you consider Tampa real estate investment? Many real estate investors have asked themselves if buying a property in Tampa is a good investment. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers.

Let’s talk a bit about Tampa before we discuss what lies ahead for investors and homebuyers. Tampa is a minimally walkable city in Hillsborough County with a population of approximately 335,749 people. With a population of more than 4 million, the Greater Tampa Bay area includes the Tampa and Sarasota metro areas. It is not only an attractive metropolitan area but is also one of the most frequently visited tourist destinations. One of the goals of investing in real estate is to get a positive return on the investment when the investor decides to sell the property in the future.

If the appreciation rate is high enough, the extra value of the house in a few years will offset the upfront costs of buying. If the appreciation rate is too low then it won’t. Tampa properties have a track record of being one of the best long-term real estate investments in the U.S. owing to the growth in employment opportunities. This has led to a persistent imbalance between demand and supply. There is a continuing housing shortage leading to a surge in home prices in this region.

Tampa is gaining popularity owing to its hot housing market where several investors have been putting in their stakes. The rental market is very strong in Tampa Bay. It is one of the top locations for buying rental property in Florida. There are several economic and development prospects attached to this market and Tampa, FL is of the hottest real estate markets in the U.S. in 2020.

If you are looking to make a profit, you don’t want to buy the most expensive property on the Tampa real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Tampa that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider.

Let’s take a look at the number of positive things going on in the Tampa real estate market which can help investors who are keen to buy an investment property in this city.

Growing Tampa Bay Metro Area

Tampa, Florida is one of the fastest-growing metropolitan areas of the country with a busy downtown area, a range of eateries, and tourist attractions. Investors who choose this market will experience high growth in their investments as it is currently one of the hottest grounds for residential and commercial properties. It also offers a great overall quality of life making it a popular residential for many family units. It is not only a growing real estate market, but it is also one of the most popular recreational hubs of the city.

People choose to reside here because of the great prospects of life that it offers, and this directly impacts the Tampa real estate market. The healthcare, education, and transportation facilities in Tampa are also impeccable which is why families with young children and many retirees prefer Tampa and are choosing to reside in Tampa since it offers them an upgraded quality of life. Not only that, but Tampa also hosts several entertainment activities for people of all age groups depending on their tastes.

Rising Home Prices & Rents

The prices of residential properties in Tampa are growing at a fast pace, though they are still affordable compared to other real estate markets in the country. This is the time for investors to get hold of properties and keep them for some time before selling them at a higher price since Tampa real estate will appreciate them over the next year. Investors can buy properties at lower rates right now and rent them out to new residents of the city to improve their cash flows.

Later on, when the selling price of homes increases then they can sell out to better prospects. This means that the Tampa real estate market is promising for short-term leases at this point, including rental homes and tourist accommodations. If you only have 10% to put down, a single-family home would be a better option for buying an investment property. It just makes sense when you consider it will be easier to get a loan, and there are no restrictions on rentals.

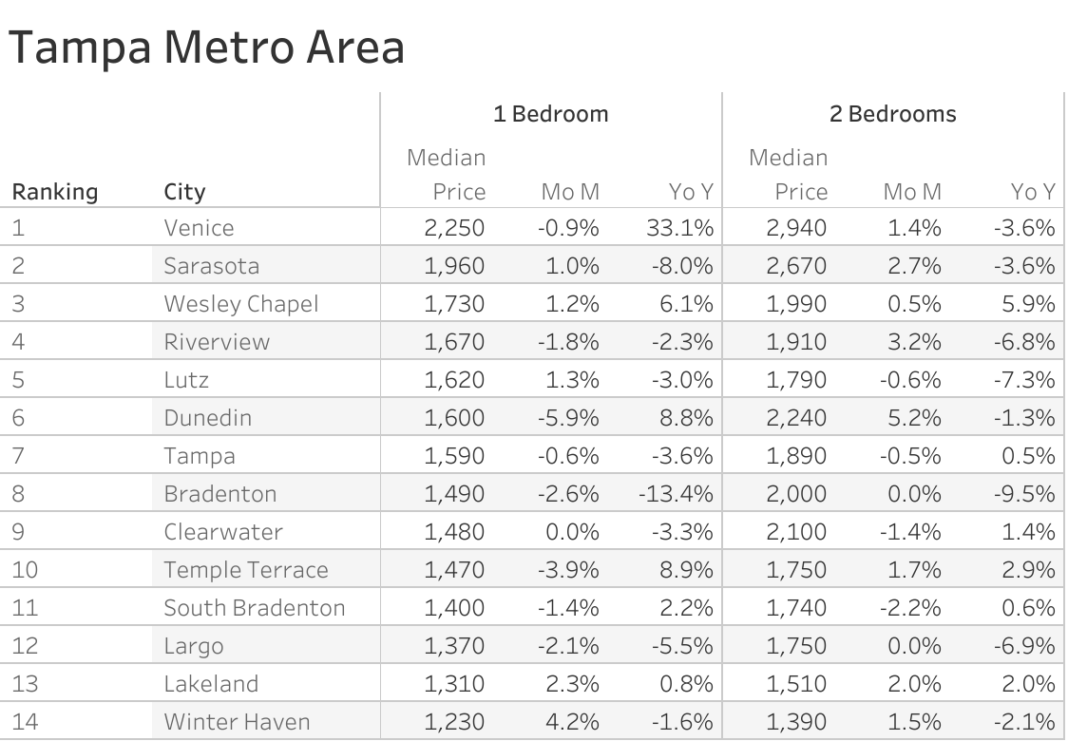

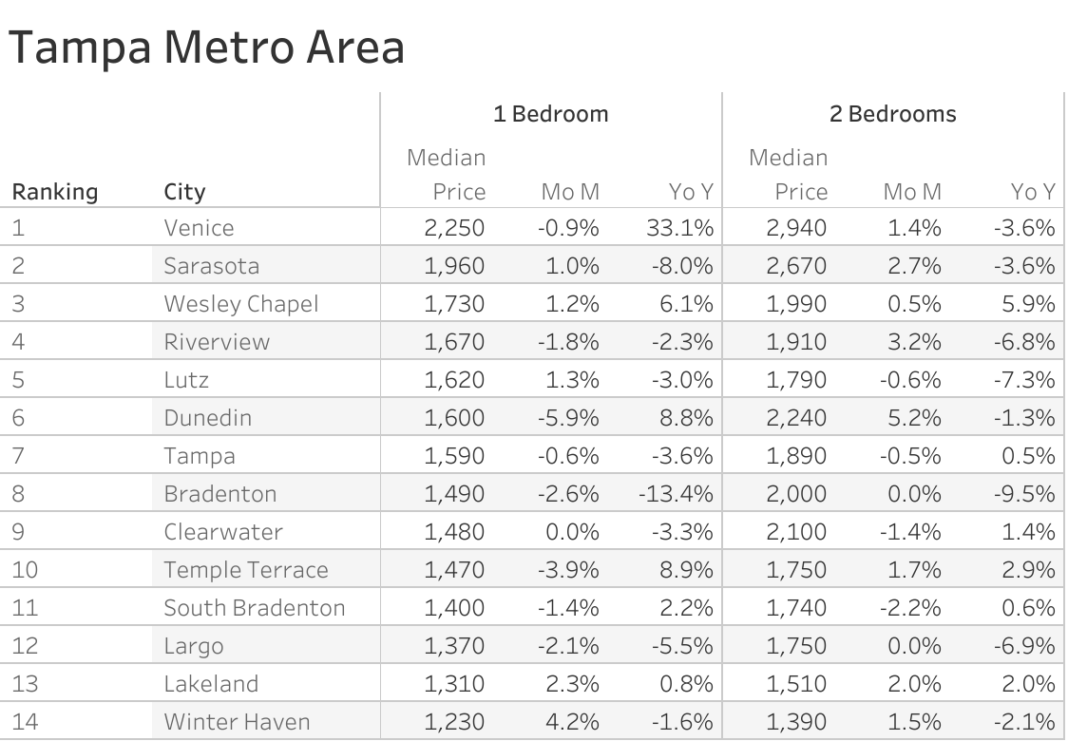

The Zumper Tampa Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Florida one bedroom median rent was $1,638 last month. Venice was the most expensive city with one bedrooms priced at $2,250 while Winter Haven ranked as the most affordable city with rent at $1,230.

The best place to buy rental property is about finding growing markets. Cities like Sarasota & Largo are good for investors looking to get started with rental property ownership at an affordable price. These cities look good for rental property investment this year as rents are growing over there. These trends provide a macro look at the growing rental demand. Each real estate market has its own unique supply-demand dynamics with unique neighborhoods that present their own opportunities for investors.

Here are the best areas to invest in a rental property in the Tampa Metro Area. Most of these places have the same things in common, including rising rents and increasing property values.

The Fastest Growing Rental Markets in the Tampa Metro Area (Year-over-Year)

- Venice had the fastest growing rent, up 33.1% since this time last year.

- Temple Terrace saw rent climb 8.9%, making it second.

- Dunedin was third with rent jumping 8.8%.

The Fastest Growing Rental Markets in the Tampa Metro Area (Month-over-Month)

- Winter Haven had the largest monthly growth rate, up 4.2%.

- Lakeland was second with rent climbing 2.3% last month.

- Lutz saw rent increase 1.3%, making it third.

Tampa’s Booming Economy

Job growth in an area is a sure way of boosting its real estate market for both residential and commercial properties. Tampa’s real estate market has also experienced similar growth in requirements for single and family homes since more people are moving to this flourishing metropolitan area for jobs. The influx of people into Tampa is especially occasioned by the fact that it is one of the fastest-growing job hubs in the country. Tampa has the headquarters of four Fortune 500 companies which makes it a moderately attractive city for work and economic growth.

In addition to this, many entrepreneurs and small businesses are also making their way to Tampa in the search for better prospects and lesser expenses for running their start-ups. Acquiring residential spaces is one of the earliest priorities for such professionals when they move here. Tampa has a very diverse economy with financial services, STEM, health care, research, education, tourism, beaches, and military bases all making significant contributions to jobs and growth.

Tampa Bay’s Tourist Attraction

There are several nature parks, landmarks, museums, and eateries for tourists to visit in Tampa. Tourist influx also means an increase in short-term residential contracts, which is a selling point of the Tampa real estate market in 2020. Main tourist attractions include Big Cat Rescue, Busch Gardens Florida, Eureka Springs Park, and Tampa-Bay History Center among many others. Growing tourism has a tremendously positive effect on the real estate in Tampa, FL.

The vibrant living environment of the city owes a great deal to its comfortable temperature. The average temperature is 99 F which is extremely moderate and allows for better productivity in human lives. The weather conditions are also an important factor when it comes to motivating people to move here.

Cost of Living in Tampa

Since there is prospective growth in the Tampa real estate market, people from all over the country are considering a move here. One of the most important reasons is the affordable cost of living in Tampa compared to other cities. This has made it a top choice for retirees and small families that are looking for residence and to generally improve the quality of their life.

- Tampa, Florida’s cost of living is 5% lower than the national average

- Tampa’s housing expenses are 23% lower than the national average and the utility prices are 16% higher than the national average.

- Transportation expenses like bus fares and gas prices are 6% higher than the national average.

- Healthcare in Tampa is 2% lower than the national average.

Maybe you have done a bit of real estate investing in Tampa but want to take things further and make it into more than a hobby on the side. It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. Compared to markets in Atlanta, Nashville, and Cleveland, Tampa has higher prospects when it comes to residential and commercial property investments. The Tampa real estate market has been projected to grow steadily during 2020. Investors are recommended to buy Tampa investment properties now and hold on to them until good price appreciation for maximum return on investment.

The Tampa housing market has been seeing constant development for the last two years, a trend that does not seem to be stopping any time soon. Realtor.com had rated the top 100 markets according to factors including employment growth, household growth, and unemployment. In all categories, the Tampa real estate market fares considerably better than the national average. The one category in which Tampa FL real estate market especially shines is new-home starts, predicted to soar by more than 20 percent next year. That would ease one of the biggest constraints on the local real estate market – a shortage of homes for sale.

The biggest demand will continue to be for “moderately priced homes” — those under $300,000 in most places but the $500,000 to $800,000 range inexpensive South Tampa. Good cash flow from Tampa investment properties means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Tampa real estate investment opportunity would be key to your success. If you invest wisely in Tampa real estate, you could secure your future.

The three most important factors when buying real estate anywhere are location, location, and location. The location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties. Demand would raise the price of your Tampa investment real estate and you should be able to flip it for a lump sum profit.

The neighborhoods in Tampa must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. Some of the best neighborhoods in Tampa, Florida are Old Seminole Heights, Sun Bay South, Tampa Palms, Spring Hill, Tampa Heights, Oldsmar, Grand Hampton, Davis Islands, Palma Ceia, Ybor City Historic District, Parrish, South Tampa, Hyde Park, Tampa Palms, Westchase, Temple Terrace, Riverside Heights, and New Tampa.

Apart from the Tampa real estate market, you can also invest in another hot market in Ocala, Florida. Ocala is an affordable real estate market for investors who can still reap a decent return on investment. The area has recovered from the Great Recession, and several factors will insulate it from a future downturn. The Ocala housing market is buoyed by several nearly recession-proof industries. It is quite affordable for investors compared to the rest of Florida markets like Tampa where the median home value is $221,500. The median home price in Ocala is $163,179. You can buy several homes in the Ocala FL real estate market for the price you would of one mid-market condo in Miami.

Also, given that this is Florida, it shouldn’t be surprising that retirees are a disproportionately large source of demand for Ocala rental houses. A large number of retirees here creates significant demand for medical professionals and caregivers. The horse-centered community offers several good-paying jobs to trainers, veterinarians, and animal caregivers. There are several manufacturers in the area such as mobile home manufacturers and EMS vehicle makers.

Another market that we suggest is the housing market in Lakeland, Florida. The Lakeland FL real estate market presents the perfect balance of currently affordable real estate for buyers and future growth. We can expect the population of the area to grow rapidly, and the renting population will grow even faster. The time to buy real estate in Lakeland is now. While the Lakeland FL real estate market is cheaper than Orlando and Tampa, it is not a good overall value given the lower average wages of its residents.

That explains why U.S. News and World Report gave the city an index score of 5.5 out of ten. This is due to the average resident earning around $23,000 a year, several thousand less than the U.S. average. Median household incomes are no better. The median household income in Lakeland, Florida is around $40,000, more than ten thousand dollars below the national average. This creates a strong demand for Lakeland rental homes, especially those that low-income residents can afford.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Tampa, Florida.

Consult with one of the investment counselors who can help build you a custom portfolio of Tampa turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Tampa.

Not just limited to Tampa or Florida but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Tampa turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Let us know which real estate markets in the United States you consider best for real estate investing!

References

Latest Market Data, Trends, and Statistics

https://tamparealtors.org/

https://www.floridarealtors.org/

https://www.zillow.com/tampa-fl/home-values

https://www.tampabay.com/news/real-estate

https://www.neighborhoodscout.com/fl/tampa/real-estate

https://www.realtor.com/realestateandhomes-search/Tampa_FL/overview

https://tamparealtors.org/resources/market-stats/

10 Reasons to live in Tampa

https://www.bestplaces.net/economy/city/florida/tampa

https://www.touristmaker.com/blog/10-reasons-live-tampa-bay-florida

Top Rental Property Markets

http://lakerlutznews.com/lln/?p=54818

https://www.mashvisor.com/blog/top-10-market-buying-rental-property

This post was originally published on 3rd party site mentioned in the title of this site