Regulatory Bodies Release Statement on Financial Abuse of Seniors

Financial abuse of seniors is a growing concern worldwide, as the elderly population becomes increasingly vulnerable to exploitation. In response, regulatory bodies have released a comprehensive statement addressing this critical issue. This article delves into the details of the statement, explores the implications for seniors, and highlights measures to combat financial abuse.

Understanding Financial Abuse of Seniors

Financial abuse of seniors involves the illegal or improper use of an elderly person’s funds, property, or assets. This form of abuse can be perpetrated by family members, caregivers, or strangers, and often goes unnoticed due to the victim’s isolation or cognitive decline.

Common Forms of Financial Abuse

- Unauthorized use of credit cards or bank accounts

- Forging signatures on financial documents

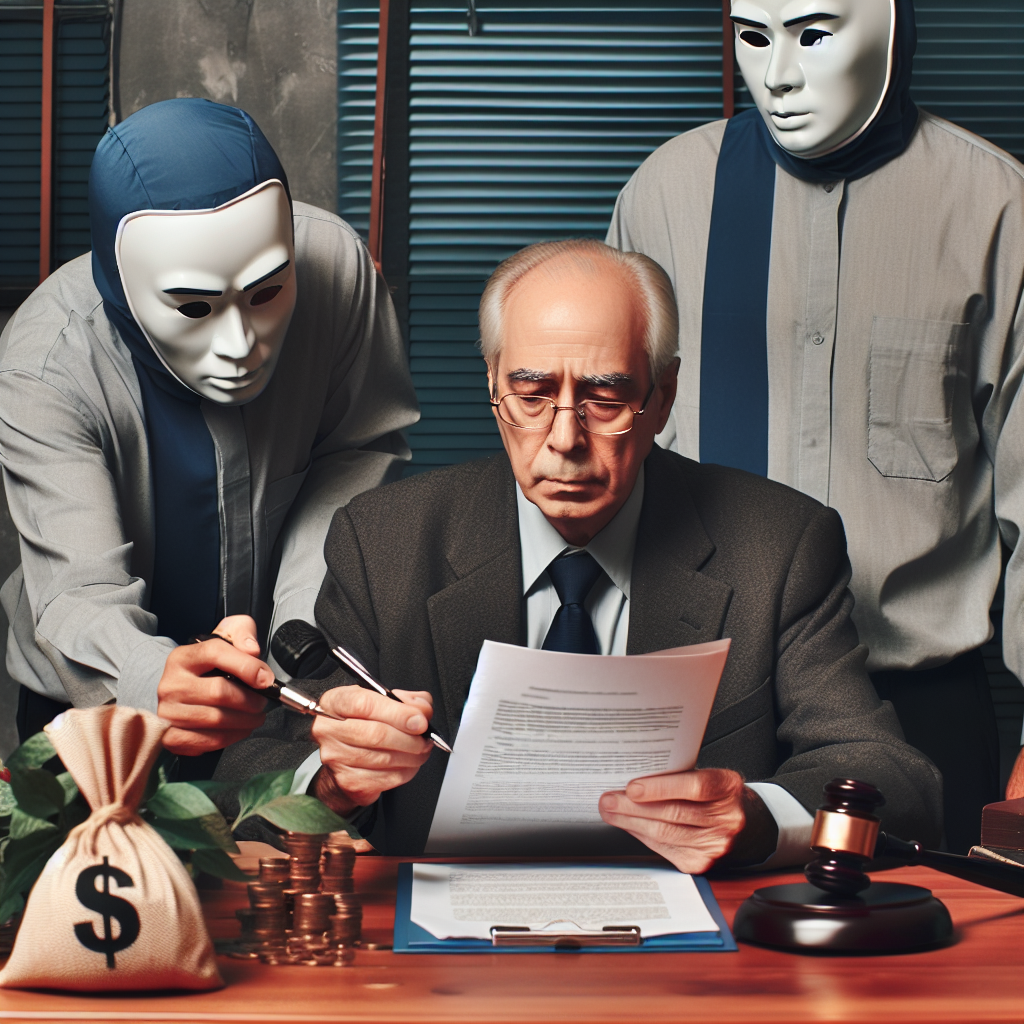

- Coercing seniors into signing legal documents

- Investment fraud and scams

- Theft of cash or valuables

Regulatory Bodies Take Action

In a recent statement, regulatory bodies such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) have outlined their commitment to protecting seniors from financial abuse. The statement emphasizes the need for increased vigilance and collaboration among financial institutions, law enforcement, and social services.

Key Initiatives Announced

- Enhanced training for financial professionals to recognize signs of abuse

- Implementation of stricter reporting requirements for suspected abuse cases

- Development of educational resources for seniors and their families

- Collaboration with technology companies to improve fraud detection tools

Case Studies Highlighting the Issue

Several high-profile cases have brought attention to the financial abuse of seniors. For instance, a 2019 case in California involved a caregiver who embezzled over $200,000 from an elderly client by forging checks and making unauthorized withdrawals. This case underscores the importance of monitoring financial transactions and maintaining open communication with trusted family members.

Another example is the widespread “grandparent scam,” where fraudsters pose as grandchildren in distress, requesting money for emergencies. This scam has cost seniors millions of dollars annually, highlighting the need for increased awareness and preventive measures.

Statistics on Financial Abuse of Seniors

According to the National Council on Aging, approximately 5 million older adults are victims of financial abuse each year, with losses estimated at $36.5 billion annually. These figures underscore the urgent need for regulatory intervention and public awareness campaigns.

Preventive Measures for Seniors and Families

To protect seniors from financial abuse, families and caregivers can take several proactive steps:

- Regularly review bank statements and financial documents

- Establish a power of attorney with a trusted individual

- Educate seniors about common scams and fraud tactics

- Encourage open communication about financial matters

- Utilize fraud alert services offered by financial institutions

Conclusion

The statement released by regulatory bodies marks a significant step forward in addressing the financial abuse of seniors. By implementing stricter regulations, enhancing education, and fostering collaboration, these organizations aim to protect the financial well-being of the elderly population. Families, caregivers, and seniors themselves must remain vigilant and informed to prevent exploitation. As awareness grows, it is hoped that the incidence of financial abuse will decline, ensuring a safer and more secure future for seniors.