New York City boasts one of the most recognizable housing markets in the world. Fueled by a vibrant economy and iconic status, it consistently attracts a wave of residents seeking a piece of the Big Apple dream. However, before diving into this dynamic market, understanding current trends and price points is crucial.

Renowned for its high cost of living, New York City requires a substantial investment in housing. This article unpacks everything you need to know, including median home values, market tendencies, and valuable insights for navigating this competitive housing market. Here are the latest trends in the NYC housing market.

Trends in the NYC Housing Market

The New York City housing market is in a state of transition. While record-high asking prices persist, buyers are starting to regain the upper hand. This article explores the current market trends across the five boroughs, highlighting opportunities and challenges for both buyers and sellers.

Median asking prices remain high, with Manhattan reaching a new peak of $1.1 million in March 2024. This follows a year of steady growth, with prices across the city rising over 10% compared to March 2023. However, despite these high price tags, buyers are finding more room for negotiation.

The typical sale-to-list price ratio is nearing pre-pandemic levels, indicating a shift in power dynamics. In a seller’s market, bidding wars drive prices up, and properties often sell close to or even above the asking price.

Conversely, a buyer’s market allows for more negotiation, with sellers often accepting offers below the initial listing price. This is precisely what we’re starting to see in NYC, with the sale-to-list price ratio approaching figures observed in 2019, when a glut of unsold condos led to a more buyer-friendly market.

Limited new listings are keeping the sales market competitive, especially for well-priced homes. This scarcity is a significant factor contributing to the buyer leverage we’re seeing.

With fewer options to choose from, buyers are more likely to engage in bidding wars for properties that meet their criteria and are priced competitively. This creates a fast-paced market where attractive listings sell quickly.

Buyers Take Charge in a Buyer’s Market

Despite high asking prices, there’s a shift in power dynamics. The current market leans more towards buyers, who have more room for negotiation. This is evident in the sale-to-list price ratio, which is approaching figures seen in 2019, a time when buyer demand wasn’t outpaced by limited inventory. This means that in many cases, sellers are accepting offers below the initial asking price.

Manhattan, with its luxury market, is experiencing this trend most acutely. Wealthy buyers are increasingly opting for rentals due to higher financing costs and economic uncertainty. As a result, sellers in Manhattan are facing a smaller pool of buyers with larger budgets, leading to more wiggle room on price.

Limited Listings Keep the NYC Housing Market Active

While buyers have more leverage, the market remains competitive due to a lack of new listings. Well-priced homes are flying off the shelves, selling quickly and often below the asking price. This suggests that sellers who are realistic about pricing will likely find buyers relatively quickly. However, homes that are overpriced may languish on the market for extended periods.

The scarcity of new listings is expected to continue this spring, particularly in Brooklyn. This limited selection will likely fuel bidding wars for desirable properties, especially in Brooklyn’s brownstone neighborhoods. Here, townhouses are experiencing a surge in demand, with neighborhoods like Park Slope and Carroll Gardens witnessing brisk sales activity.

Beyond the allure of these historic homes, Brooklyn’s appeal is further bolstered by a median asking price that remains slightly below the citywide average. This makes Brooklyn an attractive option for buyers seeking more space for their dollar compared to Manhattan.

Queens Heats Up as Inventory Rises

Queens stands out as the sole borough where new listings are on the rise. This influx of inventory, coupled with steady buyer demand, is pushing prices upwards in the borough. However, with a median asking price still well below the citywide average, Queens offers a more affordable entry point for many buyers. This is particularly true for first-time homebuyers or those looking to upsize without breaking the bank. While trendy areas like Long Island City and Astoria are experiencing significant growth, there are still plenty of neighborhoods in Queens that offer good value and a strong sense of community.

Looking Ahead: A More Balanced NYC Market

The spring of 2024 is expected to see a more balanced market compared to the past two years. While buyers will have more negotiating power, competition for well-priced properties is likely to remain high. For buyers, securing a strong offer and partnering with an experienced local agent are crucial steps towards success.

A qualified agent can help buyers navigate the complexities of the NYC market, identify the right property within their budget, and guide them through the negotiation process.

Mortgage rates are likely to stay elevated in the near future. However, a potential rate cut by the Federal Reserve in the latter half of the year could incentivize more sellers to list their properties, increasing overall inventory. This, in turn, could lead to a more balanced market with more options for buyers.

Trends in the New York Real Estate Market

The New York real estate market in the first quarter of 2024 presented a fascinating paradox for investors. On one hand, historically low inventory levels created a seller’s market with rising prices.

On the other hand, increasing mortgage rates put a damper on affordability and tempered buyer enthusiasm, leading to a slight softening in sales activity. Let’s delve deeper into these trends and explore what they might mean for investors.

- Prices gazed upward as the Median Sales Price was up 6.2 percent to $383,500.

- Pending Sales in New York State were up 2.0 percent to 24,352.

- Closed Sales decreased 4.7 percent to 20,430.

- Inventory shrunk 14.7 percent to 23,924 units.

- Days on Market decreased 7.7 percent to 60 days.

- Months Supply of Inventory was down 7.1 percent to 2.6 months.

Inventory Squeeze: A Double-Edged Sword

The ongoing shortage of available homes is a double-edged sword for investors. While it signifies a potentially strong seller’s market, finding the right property becomes an uphill battle. Bidding wars and competition for even slightly desirable listings are likely to be fierce. This necessitates a lightning-fast approach and the ability to act decisively. Investors who can move quickly and present attractive offers may find themselves well-positioned to secure deals.

However, the low inventory also presents a waiting game. With fewer options on the market, some sellers might struggle to find buyers willing to meet their asking price, especially if their property lingers on the market for an extended period. This could lead to increased seller motivation and potentially create buying opportunities for investors who are patient and strategic.

Sales Soften, But is it a Buyer Retreat or a Strategic Pause?

The dip in closed sales during Q1 2024 could be interpreted in a few ways. Rising interest rates undoubtedly affect affordability and may have discouraged some buyers from entering the market. However, it’s important to consider the possibility of a strategic pause by potential buyers. With the market dynamics shifting, some buyers might be adopting a wait-and-see approach, waiting for the right opportunity or for prices to potentially stabilize.

The rise in pending sales towards the end of the quarter offers an interesting counterpoint. This could indicate pent-up buyer demand waiting for the right property to hit the market, or it could signal an adjustment of buyer strategies to the new market realities. Here, close attention to market trends and data in the coming months will be crucial for investors to understand if this is a temporary blip or the beginning of a sustained shift in buyer behavior.

Rising Rates: A Cause for Concern, But Not a Dealbreaker

The climb in mortgage rates is undoubtedly a concern for investors, impacting purchasing power and potentially leading to a decrease in the pool of qualified buyers. However, it’s important to remember that interest rates are just one factor in the overall investment equation. Savvy investors will consider factors like rental income potential, long-term appreciation prospects, and overall property value to determine if a deal makes sense even in a higher interest rate environment.

The New York real estate market is complex, and these are just some of the considerations for investors in Q1 2024 and beyond. Remember, seeking guidance from a qualified real estate professional who understands your specific investment goals and risk tolerance is crucial for making informed decisions in this ever-evolving market.

New York Real Estate Market Forecast: A Look Ahead

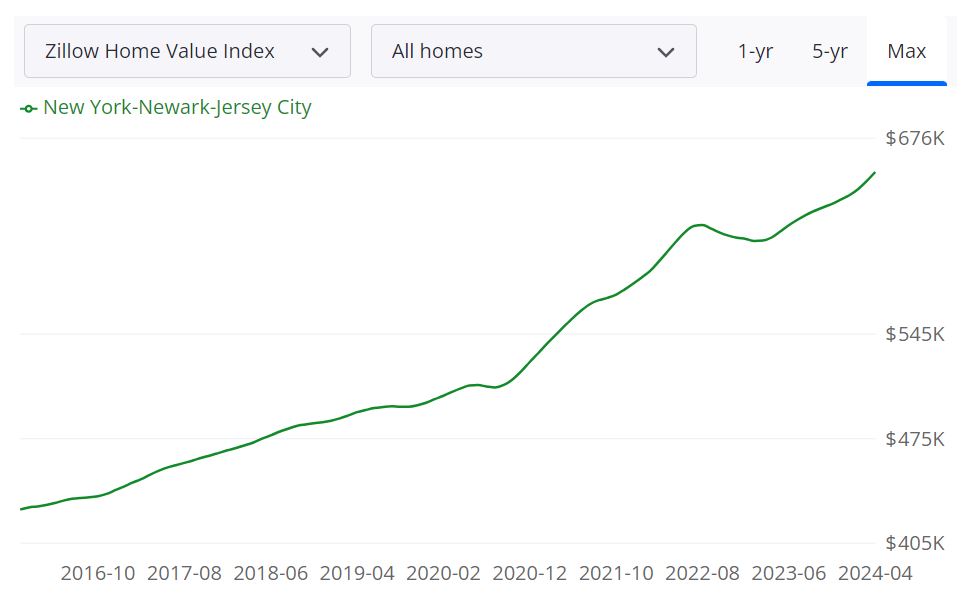

The New York City metropolitan area, including Newark and Jersey City, remains a hot property market, with home values averaging a cool $654,172 (Zillow) – that’s a healthy jump of 7.2% compared to last year.

Houses are also flying off the shelves, typically going into pending status within 23 days. But is this a gold rush destined to continue, or are there storm clouds gathering on the horizon? Let’s dive into the data and see what the future holds for New York real estate.

A Market in Transition

The forecast of a 2.2% dip by April 2025 shouldn’t send chills down the spines of long-term investors. It’s important to remember that real estate markets are cyclical, and periods of rapid growth are naturally followed by periods of stabilization or correction. This is a healthy pattern that allows the market to catch its breath and prevents unsustainable bubbles from forming.

While there may be a slight price adjustment in the coming year, New York City remains a desirable and dynamic place to live, and property values are likely to continue trending upwards over the long term. Savvy investors will use this potential cool-down as an opportunity to enter the market at a more attractive price point.

Numbers to Know

Here’s a snapshot of the current market to help you get a grip on where things stand:

- Median Sale Price (as of March 31, 2024): $564,167. This is the real number most buyers pay, and it’s a good benchmark for valuing properties.

- Median List Price (as of April 30, 2024): $699,333. This is the price sellers ask for, and it can be higher than the eventual selling price.

- Sales Over List Price (as of March 31, 2024): 44.7%. In a competitive market like New York, bidding wars are common, pushing the final price above the asking price.

- Sales Under List Price (as of March 31, 2024): 43.6%. Not all properties spark bidding wars. This figure indicates a healthy balance in the market, with some properties selling below the asking price.

As depicted in this graph of Zillow, home values have increased year-over-year. This upward trend is expected to persist, with forecasts indicating continued growth over the next year.

Regional Housing Market Forecast in New York

The New York housing market presents a picture of moderate and steady growth across various regions. While the data provided doesn’t include figures for May 31st, 2024, it offers projections for July 31st, 2024, and April 30th, 2025. Let’s delve into what these forecasts suggest for potential buyers and sellers in different parts of the state.

Upstate New York: Steady Climb Expected

Across upstate New York, including areas like Kingston, Rochester, Syracuse, Jamestown, Olean, and Hudson, forecasts indicate a trend of consistent growth. These regions are expected to see price increases ranging from 0.9% to 2.1% by July 31st, 2024, with projections for continued growth reaching 1.7% to 3.2% by April 30th, 2025. This suggests a stable market with consistent appreciation for sellers and potentially competitive conditions for buyers.

Central and Western New York: Moderate Growth Anticipated

Regions in central and western New York, such as Amsterdam, Seneca Falls, Buffalo, Batavia, Auburn, Gloversville, Utica, and Binghamton, are also forecast for moderate growth. Price increases are expected to fall within a range of 1.2% to 2.1% by July 31st, 2024, with projections for a slower but steady increase reaching 0.9% to 1.8% by April 30th, 2025. These areas are likely to see a balanced market with opportunities for both buyers and sellers.

Important Considerations for the New York Market

While the forecast suggests a generally positive outlook for the New York housing market, some external factors can influence local conditions. Here are some key considerations:

- Impact of National Trends: National economic conditions and national housing market trends can affect the New York market. Staying informed about broader market dynamics is crucial.

- Local Market Dynamics: Specific factors like job markets, demographics, and available inventory can influence housing prices in individual cities and towns. Researching the specific area you’re interested in is vital.

- Inventory Levels: The level of available inventory plays a significant role. Low inventory can lead to bidding wars and price increases, while high inventory can favor buyers.

Places in New York Poised for Home Price Increases

| RegionName | BaseDate | 30-04-2025 |

|---|---|---|

| Kingston, NY | 30-04-2024 | 3.2% |

| Rochester, NY | 30-04-2024 | 3.1% |

| Syracuse, NY | 30-04-2024 | 2.8% |

| Jamestown, NY | 30-04-2024 | 2.7% |

| Olean, NY | 30-04-2024 | 2.1% |

| Hudson, NY | 30-04-2024 | 2% |

| Amsterdam, NY | 30-04-2024 | 1.7% |

| Seneca Falls, NY | 30-04-2024 | 1.7% |

| Buffalo, NY | 30-04-2024 | 1.4% |

| Batavia, NY | 30-04-2024 | 1.3% |

| Auburn, NY | 30-04-2024 | 1.2% |

| Gloversville, NY | 30-04-2024 | 1% |

| Utica, NY | 30-04-2024 | 0.9% |

| Binghamton, NY | 30-04-2024 | 0.5% |

| Oneonta, NY | 30-04-2024 | 0.2% |

This table presents the forecasted trends for April 2025 in various regions across New York State, providing insights into the anticipated housing market conditions.

Overall, the New York housing market offers opportunities for both buyers and sellers seeking a stable and growing market. By understanding regional variations, the impact of external factors, and local market dynamics, informed decisions can be made in this dynamic landscape.

Will the New York Housing Market Crash?

Experts predict a dramatic crash in New York’s housing market is unlikely in 2024. Two key factors underpin this forecast:

- Persistent inventory shortage: Unlike the situation leading up to the 2008 housing crisis, the current market faces a critical imbalance – there simply aren’t enough houses available to meet buyer demand. This scarcity helps prevent a freefall in prices because there’s still a competition to buy the limited properties on the market.

- Underlying strength in demand: New York City’s status as a global center for finance, business, and culture continues to attract people. This steady population growth translates to a consistent need for housing, keeping demand afloat.

However, a cool-down from the recent seller’s market frenzy is likely. Here’s a breakdown of what to expect:

- Moderated price growth: The double-digit price increases seen in recent years are likely to ease up. Forecasts suggest a shift towards slower growth, with prices potentially stagnating or even dipping slightly.

- Reduced bidding wars: With rising mortgage rates and a more cautious economic outlook, buyers may be less aggressive. This could lead to a decrease in cutthroat bidding wars, making the buying process somewhat less competitive for hopeful homeowners.

Beyond the immediate forecast, here are some additional factors that could influence the New York housing market:

- Interest rates: Mortgage rates are a significant factor in housing affordability. If rates continue to rise, it could dampen buyer enthusiasm and put downward pressure on prices. Conversely, a drop in rates could reignite a buying frenzy.

- National economic conditions: A strong national economy typically translates to a healthy housing market. Conversely, an economic downturn could lead to job losses and a decrease in housing demand.

- Government policies: Government policies, such as tax breaks for first-time homebuyers or regulations on short-term rentals, can also impact the housing market.

Overall, while a crash is improbable, the New York housing market is likely to transition into a more balanced state. This could benefit buyers who have been priced out of the market in recent years. However, sellers may need to adjust their expectations regarding sale prices and timelines. It’s important to stay informed about the latest market trends and economic data to make informed decisions about buying or selling a home in New York.

New York Rental Market Report

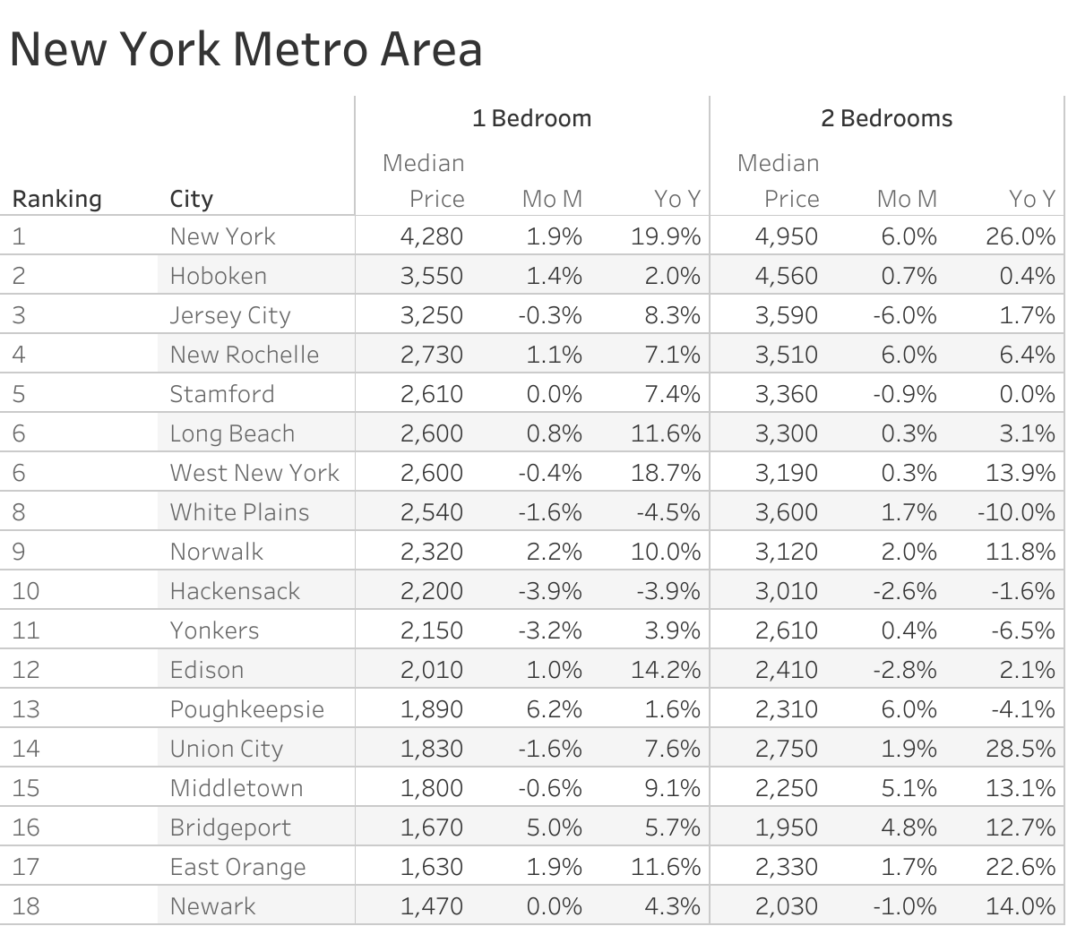

The Zumper New York City Metro Area Report analyzed active listings across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The New York one-bedroom median rent was $2,430 last month. New York City was the most expensive market with one-bedrooms priced at $4,280 whereas Newark was the most affordable city with rent priced at $1,470.

Here are the places where it makes sense to invest in rental properties in the New York City Metro Area. These are the places where the demand for rentals is growing strong in 2024.

The Fastest Growing Cities For Rents in New York City Metro Area (Y/Y%)

- New York City had the fastest growing rent, up 19.9% since this time last year.

- West New York saw rent climb 18.7%, making it second.

- Edison rent was the third fastest growing, jumping 14.2%.

The Fastest Growing Cities For Rents in New York City Metro Area (M/M%)

- Poughkeepsie had the largest monthly rental growth rate, up 6.2%.

- Bridgeport rent was the second fastest growing, climbing 5%.

- Norwalk was third with rent growing 2.2%.

Top Real Estate Estate Markets in New York

Buffalo real estate market

The Buffalo real estate investment offers a surprisingly good deal with low prices and relatively high rental rates. The Buffalo real estate market is dominated by older homes. A majority of homes in the Buffalo housing market were built before World War 2. Interestingly, this also means that many small apartment buildings are designed to serve a population that rented small units close to their jobs.

For example, roughly a third of homes are single-family detached homes, while almost half take the form of small apartment buildings. This creates an excellent opportunity for those in the market for Buffalo rental properties. You could buy a small apartment building with multiple tenants for the cost of a single rental property in a more expensive New York real estate market.

Syracuse real estate market

Syracuse’s real estate market offers cheaper property with a higher return on investment and a less hostile legal climate. It is one of the better choices if you want to invest in New York state. Another issue that factors into the equation is the job market. Lots of cities have a great quality of life but almost no one can afford to live there.

The Syracuse housing market ranked 6.3 out of 10 for its job market. That’s better than rural and much of upstate New York. And it is why there is a slow trickle of people moving in to replace those who leave. That’s why the Syracuse real estate market has a net migration of 5 or a stable population. This is in sharp contrast to the depopulation seen in most Rust Belt cities. It also means Syracuse’s real estate investment properties will hold their value for the foreseeable future if they don’t appreciate it.

Albany real estate market

Albany is a steadily appreciating real estate market. While it isn’t as famous or hot as NYC, it offers an affordable entry point and a massive pool of perpetual renters. Though it may not be somewhere you want to live, many locals are choosing to stay and make their homes here. And that will continue to drive demand for Albany real estate investment properties as long as they are priced right.

Rochester real estate market

You can also consider Rochester. The Rochester real estate market is stable, offering slow appreciation, affordable properties to outsiders, and good returns. It has strong, long-term potential that is only buoyed if NYC collapses. And this is one of the reasons why being everything the Big Apple isn’t is in your favor.

The Rochester real estate market enjoys a healthy population profile. Roughly a quarter of the population consists of children, and many are likely to remain due to the healthy job market. It also means that the Rochester housing market won’t crash if the job market weakens the way San Francisco collapses whenever the tech bubble bursts. Others choose to remain here because of the low cost of living.

This post was originally published on 3rd party site mentioned in the title of this site