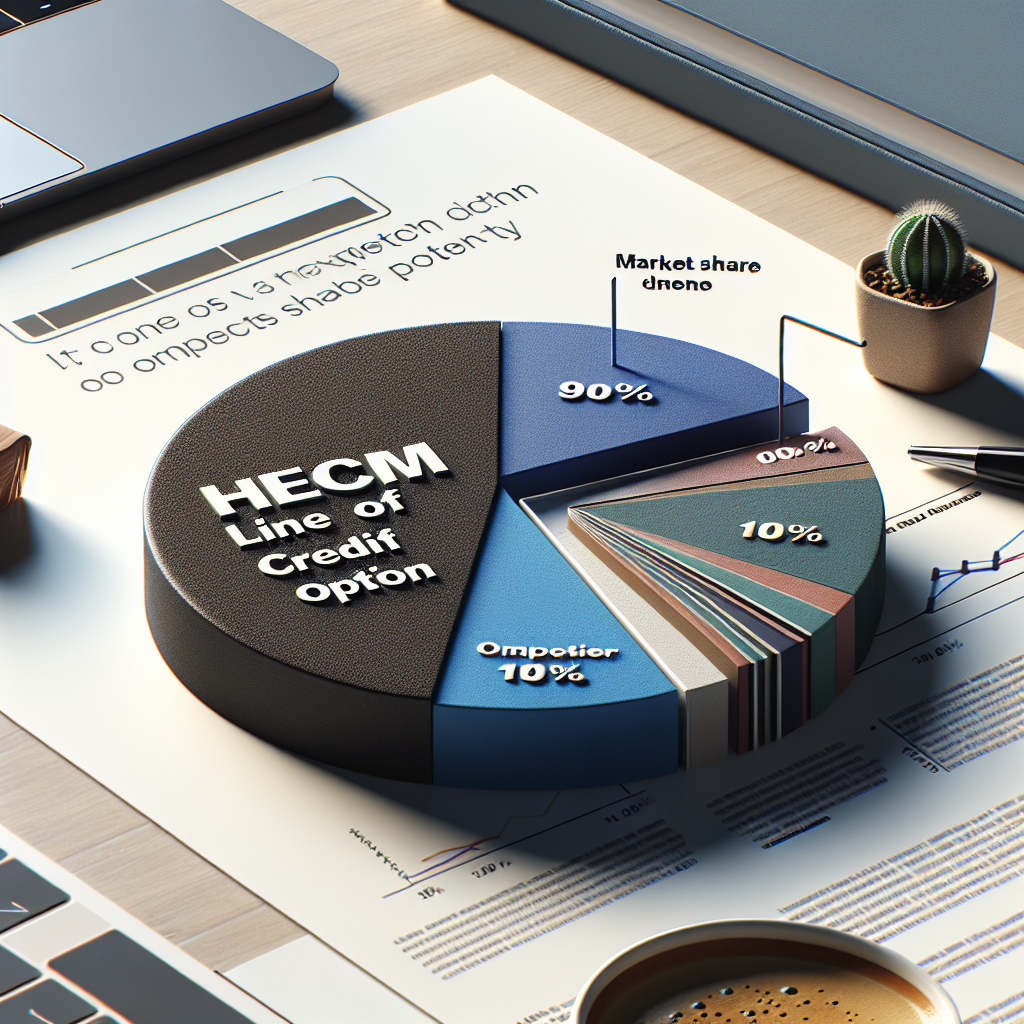

HECM Line of Credit Option Maintains 90% Market Share Dominance

The Home Equity Conversion Mortgage (HECM) line of credit has emerged as a dominant force in the reverse mortgage market, maintaining a staggering 90% market share. This financial product, designed to help older homeowners access their home equity, has become increasingly popular due to its flexibility and security. In this article, we will explore the reasons behind the HECM line of credit’s market dominance, its benefits, and its impact on the financial landscape for retirees.

Understanding the HECM Line of Credit

The HECM line of credit is a type of reverse mortgage insured by the Federal Housing Administration (FHA). It allows homeowners aged 62 and older to convert a portion of their home equity into accessible funds. Unlike traditional loans, the HECM line of credit does not require monthly mortgage payments. Instead, the loan is repaid when the homeowner sells the home, moves out permanently, or passes away.

Key Features Driving Market Dominance

Several features contribute to the HECM line of credit’s overwhelming popularity:

- Flexibility: Borrowers can draw funds as needed, providing a financial safety net for unexpected expenses.

- Growth Feature: The unused portion of the credit line grows over time, offering increased borrowing power.

- No Monthly Payments: Homeowners are not required to make monthly payments, easing financial burdens during retirement.

- Non-Recourse Loan: Borrowers or their heirs will never owe more than the home’s value at the time of sale.

Case Studies: Real-Life Applications

To illustrate the practical benefits of the HECM line of credit, consider the following case studies:

- Case Study 1: John and Mary, both in their late 60s, used their HECM line of credit to cover unexpected medical expenses. The flexibility of the credit line allowed them to access funds without disrupting their retirement savings.

- Case Study 2: Susan, a 72-year-old widow, utilized her HECM line of credit to supplement her fixed income. The growth feature of the credit line provided her with increased financial security over time.

Statistics Supporting Market Dominance

Recent statistics underscore the HECM line of credit’s market dominance:

- According to the National Reverse Mortgage Lenders Association, the HECM line of credit accounts for 90% of all reverse mortgage transactions.

- A study by the Urban Institute found that 70% of HECM borrowers prefer the line of credit option over lump-sum or monthly payment options.

Impact on Retirement Planning

The HECM line of credit has significantly impacted retirement planning strategies. Financial advisors increasingly recommend it as a tool for managing longevity risk and ensuring a stable income stream during retirement. By providing access to home equity without the burden of monthly payments, the HECM line of credit offers retirees a valuable resource for maintaining their quality of life.

Conclusion

The HECM line of credit’s 90% market share dominance is a testament to its flexibility, security, and adaptability to the needs of retirees. With features like the growth option and non-recourse protection, it offers a compelling solution for older homeowners seeking to leverage their home equity. As the financial landscape continues to evolve, the HECM line of credit remains a vital tool for ensuring financial stability and peace of mind in retirement.