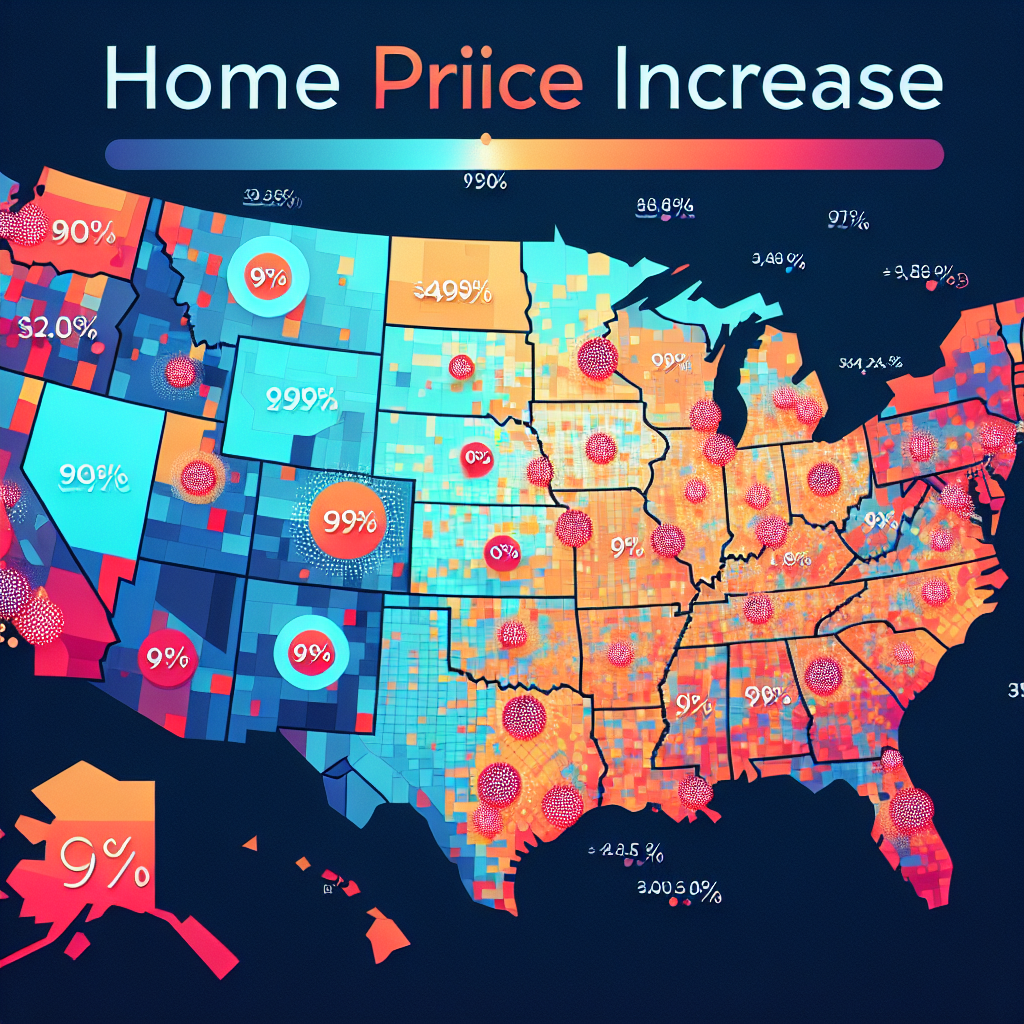

Home Prices Increase in 90% of US Metro Areas in Q3, Reports NAR

The National Association of Realtors (NAR) recently released a report indicating a significant rise in home prices across the United States. According to the data, 90% of metro areas experienced an increase in home prices during the third quarter of the year. This trend highlights the ongoing challenges and dynamics within the housing market, affecting buyers, sellers, and investors alike.

Understanding the Surge in Home Prices

The increase in home prices can be attributed to several factors that have been influencing the real estate market over the past few years. These include:

- Low Inventory: A persistent shortage of available homes has driven up competition among buyers, leading to higher prices.

- Low Mortgage Rates: Historically low mortgage rates have made borrowing more affordable, encouraging more people to enter the housing market.

- Increased Demand: The pandemic has shifted housing preferences, with more people seeking larger homes or properties in suburban and rural areas.

Regional Variations in Home Price Increases

While the overall trend shows an increase in home prices, the extent of this rise varies across different regions. Some areas have experienced more pronounced growth due to specific local factors.

Case Study: The Sun Belt Boom

The Sun Belt region, which includes states like Texas, Florida, and Arizona, has seen some of the most significant increases in home prices. This can be attributed to:

- Population Growth: Many people are relocating to these states for their favorable climate and job opportunities.

- Business Expansion: The influx of businesses and tech companies has boosted local economies, increasing demand for housing.

Contrasting Trends in the Midwest

In contrast, some Midwestern cities have experienced more moderate price increases. Factors contributing to this include:

- Stable Population: The population growth in these areas is relatively stable, leading to less pressure on housing demand.

- Affordable Housing: Historically, the Midwest has offered more affordable housing options, which can temper rapid price increases.

Implications for Buyers and Sellers

The rise in home prices has significant implications for both buyers and sellers in the current market.

Challenges for Buyers

For potential homebuyers, the increase in prices presents several challenges:

- Affordability Issues: Higher prices can make it difficult for first-time buyers to enter the market.

- Competitive Bidding: Buyers may face bidding wars, leading to offers above the asking price.

Opportunities for Sellers

Conversely, sellers are in a favorable position due to the high demand and limited supply:

- Higher Returns: Sellers can often secure higher prices for their properties.

- Quick Sales: Homes are selling faster, reducing the time properties spend on the market.

Future Outlook for the Housing Market

Looking ahead, the housing market is expected to remain dynamic, with several factors influencing future trends:

- Interest Rate Changes: Potential increases in mortgage rates could impact affordability and demand.

- Economic Conditions: The broader economic environment, including employment rates and inflation, will play a crucial role.

- Government Policies: Housing policies and incentives could affect market dynamics.

Conclusion

The NAR’s report on the increase in home prices across 90% of US metro areas underscores the complex and evolving nature of the housing market. While this trend presents challenges for buyers, it offers opportunities for sellers. As the market continues to adapt to economic and demographic shifts, stakeholders must stay informed and agile to navigate the changing landscape effectively.