The Palm Beach housing market is poised for continued growth, fueled by ongoing demand from both local and out-of-state buyers. Despite challenges such as inventory constraints and rising mortgage rates, the market remains resilient, supported by factors such as the allure of the Florida lifestyle and the area’s economic stability.

Looking ahead, market stakeholders anticipate a balanced market between buyers and sellers, with opportunities for both parties. While inventory levels may continue to be a concern in the short term, initiatives to boost housing supply and meet growing demand are underway, offering hope for a more balanced and sustainable market in the future.

Palm Bay Housing Market Trends in 2024

The Palm Beach County housing market has been experiencing significant shifts as indicated by recent data released by the MIAMI Association of Realtors and the Multiple Listing Service system

How is the Housing Market Doing Currently?

In February 2024, Palm Beach County witnessed a surge in home sales, particularly in the $1 million and above category, showcasing a 20.8% increase year-over-year. This surge is attributed to homebuyers from densely populated and heavily taxed states like New York, California, and New Jersey, who are increasingly drawn to the allure of Palm Beach County’s real estate market.

However, while the luxury segment thrives, the overall housing market experienced a slight dip of 1.8% in total sales compared to the previous year. Single-family home sales, on the other hand, showed resilience with a 5.2% increase year-over-year, while existing condo sales saw a decline of 10.1%, primarily due to inventory constraints and higher mortgage rates.

How Competitive is the Palm Beach Housing Market?

The Palm Beach housing market remains competitive, with buyers vying for limited inventory. New listings have been steadily rising, offering buyers more options than in previous years. This increase in listings, up 27.26% year-over-year, has contributed to a more balanced market dynamic, providing buyers with a variety of choices.

However, despite the uptick in new listings, inventory levels are still down 30.1% from the historical average, posing challenges for buyers in finding their ideal properties. The months’ supply of inventory for single-family homes indicates a seller’s market, while existing condominiums show a more balanced market, offering opportunities for both buyers and sellers.

Are There Enough Homes for Sale to Meet Buyer Demand?

Although new listings are on the rise, inventory levels continue to lag behind historical averages. The current inventory shortage, down 30.1% from the norm, underscores the challenge for buyers in finding suitable properties.

Furthermore, the median prices of single-family homes and existing condos have been appreciating, with a notable 11.9% increase year-over-year for single-family homes and a 4.7% increase for existing condos. This upward trend in prices, coupled with limited inventory, highlights the need for more homes to meet the growing buyer demand.

Palm Bay Housing Market Forecast for 2024 and 2025

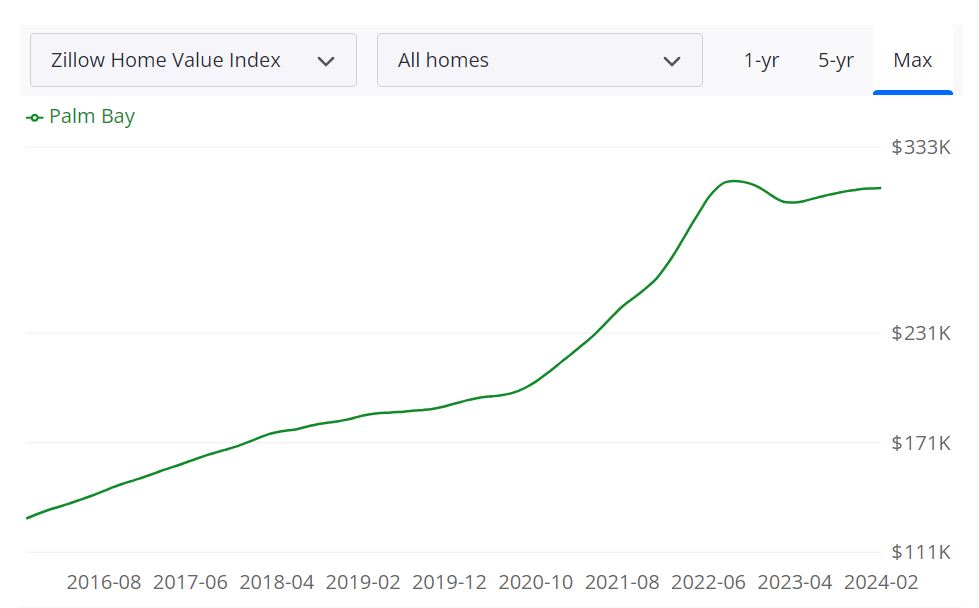

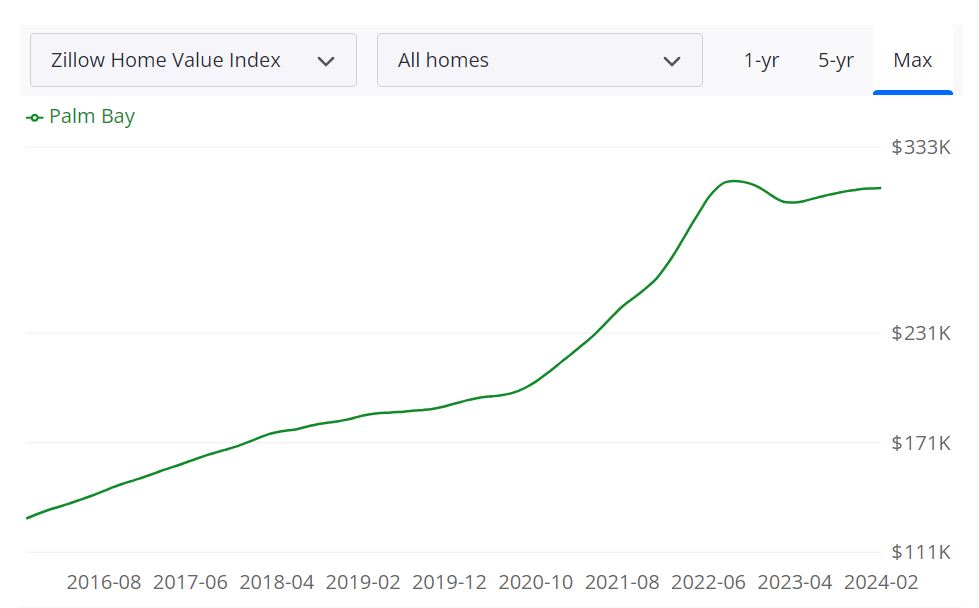

According to Zillow, the average home value in Palm Bay stands at $311,346, reflecting a modest increase of 2.0% over the past year. Homes in this area typically go to pending status within an average of 38 days, indicating a relatively brisk market.

Key Housing Metrics

For Sale Inventory: As of February 29, 2024, Palm Bay had 893 properties listed for sale, providing a snapshot of the available housing stock.

New Listings: In February 2024, there were 207 newly listed properties, indicating ongoing activity in the market.

Median Sale to List Ratio: The median sale to list ratio as of January 31, 2024, was 0.984, suggesting that homes typically sell close to their listed prices.

Median Sale Price: The median sale price, recorded in January 2024, was $295,000, giving prospective buyers an idea of the prevailing price range in the area.

Median List Price: The median list price, as of February 29, 2024, stood at $329,783, reflecting the asking prices of properties in the market.

Percent of Sales Over/Under List Price: In January 2024, approximately 18.2% of sales were over list price, while 61.8% were under list price, showcasing the negotiation dynamics between buyers and sellers.

Palm Bay MSA Housing Market Forecast

The Palm Bay Metropolitan Statistical Area (MSA) encompasses Brevard County, Florida, and is a significant player in the region’s housing market. With a forecast indicating a gradual uptick in growth, the Palm Bay MSA is poised for a 0.1% increase by March 31, 2024, followed by a more substantial 0.3% rise by May 31, 2024, and a notable 1.7% surge by February 28, 2025. This forecasted growth underscores the resilience and potential of the Palm Bay housing market within the broader Florida real estate landscape.

In terms of counties, the Palm Bay MSA primarily includes Brevard County, which serves as its economic and demographic hub. With its diverse mix of urban and suburban areas, Brevard County offers a range of housing options to cater to various preferences and budgets. The housing market in this MSA is sizable, catering to a population with diverse needs and preferences, ranging from first-time homebuyers to seasoned investors.

Is Palm Bay a Buyer’s or Seller’s Housing Market?

Assessing whether the Palm Bay housing market favors buyers or sellers involves considering various factors such as inventory levels, pricing trends, and market demand. With a relatively low median sale to list ratio and a significant percentage of sales occurring under list price, Palm Bay leans slightly towards being a buyer’s market.

However, the competitive nature of the market, as indicated by the swift turnaround time for homes going to pending status, suggests that sellers still have some leverage. Overall, while buyers may find opportunities for negotiation and selection, sellers can benefit from a market characterized by reasonable demand.

Are Home Prices Dropping in Palm Bay?

As of the latest data available, there is no indication of a significant drop in home prices in the Palm Bay area. While market conditions may fluctuate over time, the modest increase in average home value over the past year suggests a stable pricing environment. Factors such as inventory levels, economic conditions, and buyer demand can influence price trends, but currently, there is no evidence to suggest a widespread decline in home prices in Palm Bay.

Will the Palm Bay Housing Market Crash?

Predicting a housing market crash involves analyzing multiple factors, including economic indicators, lending practices, and market speculation. While no market is immune to downturns, the Palm Bay housing market does not currently exhibit signs indicative of an imminent crash.

The gradual growth forecasted for the coming months suggests a degree of stability, with market dynamics influenced by factors such as population growth and job creation. However, it’s essential for stakeholders to monitor market conditions closely and exercise caution in response to any emerging risks or vulnerabilities.

Is Now a Good Time to Buy a House in Palm Bay?

Determining whether it’s a good time to buy a house in Palm Bay depends on individual circumstances and preferences. For buyers seeking affordability and negotiation opportunities, the current market conditions may present favorable conditions. However, it’s essential to conduct thorough research, assess personal finances, and consider long-term goals before making a purchasing decision.

With stable pricing and a balanced market environment, prospective buyers in Palm Bay may find opportunities to secure their dream home at a reasonable value. Consulting with real estate professionals and staying informed about market trends can help buyers make informed decisions tailored to their needs.

Investing in Palm Beach Real Estate Market

1. Population Growth and Trends

Investors eyeing the Palm Beach real estate market can find promise in the city’s population growth and trends. The region has experienced sustained population growth, driven in part by in-migration from states like New York, California, and New Jersey. This influx of residents contributes to a robust and expanding housing market, offering a potentially lucrative landscape for real estate investors.

2. Economy and Job Opportunities

The city’s economy and job market are critical factors for real estate investors. Palm Beach County boasts a diverse and flourishing economy, with a particular emphasis on a robust luxury market. Additionally, the presence of jobs in various sectors, including real estate, healthcare, and tourism, provides a stable foundation for the real estate market. The economic vitality of the region enhances the potential for property appreciation and sustained rental demand, making it an attractive prospect for investors.

3. Livability and Quality of Life

Livability is a key consideration for real estate investors. Palm Beach offers a high quality of life, featuring beautiful beaches, cultural attractions, and a pleasant climate. The city’s desirability as a place to live can positively impact property values and rental demand. As investors evaluate potential markets, the overall livability and attractiveness of Palm Beach contribute to its investment appeal.

4. Rental Property Market Size and Growth

The size and growth of the rental property market are crucial for investors seeking long-term returns. Palm Beach County’s surging interest in mid-market homes, coupled with sustained population growth, contributes to a growing rental market. Investors can tap into this demand by providing rental properties catering to diverse segments of the population. The city’s popularity among both permanent residents and seasonal visitors further enhances the potential for a thriving rental market.

5. Other Factors Related to Real Estate Investing

- Mortgage Rates: While mortgage rates have risen, understanding the current rates and their potential impact on buyer behavior is essential for investors. The bifurcated growth in the housing market, as highlighted by MIAMI REALTORS® Chief Economist Gay Cororaton, emphasizes the importance of recognizing these trends for strategic investment decisions.

- Inventory Dynamics: Palm Beach’s inventory challenges, with a significant decrease from pre-pandemic levels, create a seller’s market. Investors should consider the supply-demand dynamics when assessing investment opportunities.

- Market Appreciation: The historical appreciation in median home prices and the city’s attractiveness for wealth migration contribute to the potential for real estate market appreciation, providing a favorable environment for investors seeking capital appreciation.

- Economic Impact: The real estate market’s contribution to the local economy, as reflected in the economic impact of home sales, adds another layer of consideration for investors evaluating Palm Beach. A thriving real estate market can have a positive cascading effect on various industries, further supporting investment prospects.

Considering Palm Beach’s population growth, economic vibrancy, livability, rental market dynamics, and various other factors, the city presents a compelling case for real estate investors. The sustained demand for properties, coupled with the region’s overall desirability, positions Palm Beach as an attractive destination for both short-term gains and long-term investment success.

References:

- https://www.zillow.com/palmbay-fl/home-values

- https://www.realtor.com/realestateandhomes-search/Palm-Bay_FL/overview

- https://www.miamirealtors.com/